Pages

- About Us

- API Management

- Art Activity

- Artificial Intelligence

- Battle Card Unify

- Battle Card V5

- Benefits of Omni-channel V5.5

- Career Form

- Carrom Tournament 2023

- Carrom Tournment

- Challenges of Omni-channel Retail

- Chess Tournament

- Christmas 2023

- Contact Us

- Cookie Policy

- Cricket 2023

- Customer Relationship Management

- Customer Testimonials

- Diwali Celebration 2023

- Diwali Celebration 2024

- Download Document

- Downloads Page Contents

- e-commerce, elevated

- eCommerce Solutions

- Elementor #11229

- Elevating Retail Performance

- Employee Testimonials

- ETP #Futuretail India 2017

- ETP #Futuretail India 2017

- ETP #Futuretail India 2017

- ETP #Futuretail Indonesia 2017

- ETP #Futuretail Indonesia 2017

- ETP #Futuretail Indonesia 2018

- ETP #Futuretail Indonesia 2018

- ETP #Futuretail Indonesia 2018

- ETP #Futuretail Malaysia 2019

- ETP #Futuretail Malaysia 2019

- ETP #Futuretail Malaysia 2019

- ETP #Futuretail Philippines 2018

- ETP #Futuretail Philippines 2018

- ETP #Futuretail Philippines 2018

- ETP at ET Great India Retail Summit & Awards 2024

- ETP at ETRetail 2023 as Omnichannel Technology Partner

- ETP at Hippindo, Modern Retail Expo 2019

- ETP at IRS 2023 as Ruby Sponsor

- ETP at IRS 2024 as Ruby Sponsor

- ETP at NRCE 2022 as Platinum Sponsor

- ETP at NRCE 2023 as Platinum Sponsor

- ETP at NRCE 2024 as Platinum Sponsor

- ETP at PRC 2022 as Omni-channel Partner

- ETP at PRC 2023 as Retail Technology Partner

- ETP at PRC 2024 as Unified Commerce Partner

- ETP at ReTechCon 2017

- ETP at ReTechCon 2017

- ETP at ReTechCon 2017

- ETP at ReTechCon 2018

- ETP at ReTechCon 2019

- ETP at ReTechCon 2024

- ETP at RLS 2017

- ETP Cloud POS & Retail Operations

- ETP Copyright Terms of Use

- ETP Event Landing Page 2024

- ETP Group at NRF APAC 2024: Retail’s Big Show Asia Pacific

- ETP Health Camp

- ETP Privacy Policy

- ETP Unify

- Event test

- FAQs

- Fun Friday

- Holi

- Home

- Independence Day

- Independence Day 2023

- IRS Indonesia 2024

- Logistics Management

- lp-template-1

- Manage your queues better with user-friendly mPOS solutions

- Marketplaces & e-Commerce Integrations

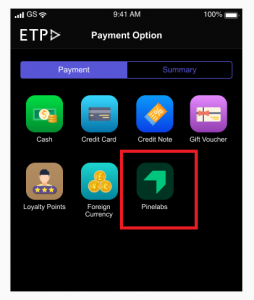

- Mobile Applications

- Navratri 2023

- new page to make live

- new page to make live 2

- new page to make live 3 – 24-09-2024

- new page to make live 3 – 24-09-2024 – Copy

- NRCE Philippines 2024

- Omni-channel for E-commerce

- Omni-channel Fulfilment

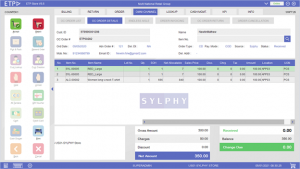

- Omni-channel POS software

- Omni-channel Retail Solutions

- Omni-channel vs Multi-channel

- Omnichannel Retail Software Company

- Our Customers

- Our Resources

- Our Solutions

- Partner Testimonials

- Partners

- Product Information Management

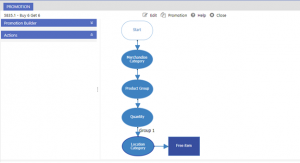

- Promotions Planning software

- Proven Retail POS Software

- Republic Day, India

- Retail Customer Relationship Management Loyalty

- Retail Inventory Management Solutions

- Retail Store Software Provider

- Seamless Integration with Partners

- Search Results

- Services

- Sitemap

- sitemap

- Smart Order Management

- Thank You

- Thank You

- Thank You Career

- The Journey to Creating Amazing Customer Experiences

- The Key Pillars of Omni-channel Success

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Tomorrow’s Business, Transformed Today India 2024

- Understanding Omni-channel Retail better

- Unified Commerce Retail Solutions

- Unified Inventory Management

- Unified Promotions Management

- Video Testimonials

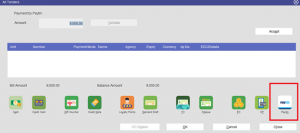

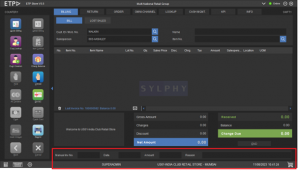

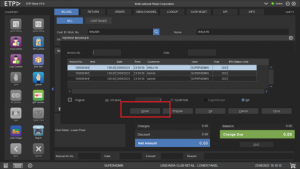

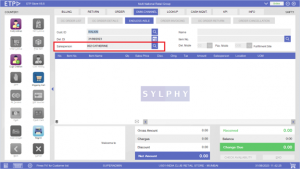

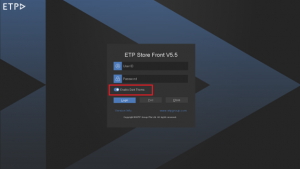

- What’s new in ETP Unify

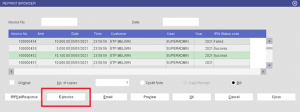

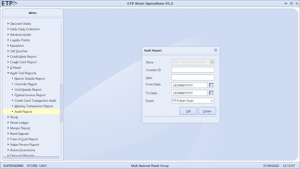

- What’s new in ETP V5

- Women’s Day